Strong and Trusted

There’s never been a better time to bank with a strong and trusted financial institution like Republic Bank of Chicago.

Who We Are

We are not First Republic Bank. We are not Republic First Bank. We are Republic Bank of Chicago.

The only “first” at Republic Bank of Chicago is our client. While our name may sound similar to some other financial institutions that have been in the news, that’s where the similarities end.

Republic Bank of Chicago remains fiercely independent and committed to serving the businesses and individuals in our communities, right here in Chicagoland. Our local roots run deep and our strength and stability run even deeper with a diversified deposit mix and loan portfolio and strong, consistent earnings. We also exceed all benchmarks to be defined as “well capitalized.”

Republic Bank of Chicago is set apart from other banks not only by our strength and stability but by our commitment to the communities we serve, investing ourselves in you and the successful future we'll build together.

Tom Bugielski, President & CEO

With nearly 5,000 banks in the United States and hundreds in just Chicagoland, it can be difficult to know which bank is tied to which bank and if you’ve made the right choice when choosing a trusted financial advisor. The only thing tied to Republic Bank of Chicago is an unwavering commitment to provide our clients with the solutions they need, the expertise they want, and the dependability they deserve to have a bright financial future.

Republic Bank of Chicago by the Numbers

Founded in 1964 on Chicago’s southwest side, Republic Bank of Chicago is now a $2.7 billion bank with strong, consistent earnings.

Capitalization as of March 31, 2025

Republic Bank of Chicago: 17.60%

Republic Bank of Chicago: 16.40%

Republic Bank of Chicago: 13.15%

Deposit Mix

Strong core relationships with businesses and individuals fuel our balance sheet.*

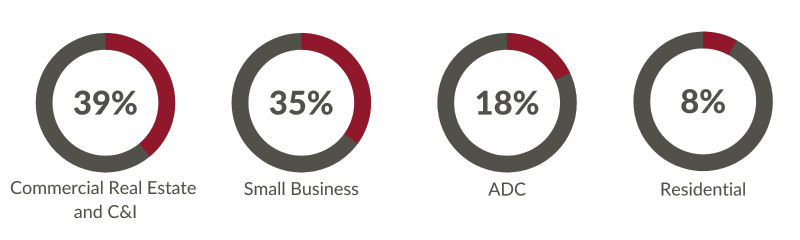

Loan Portfolio

Lending to the businesses* in our communities drives our growth and benefits us all.

Republic Bank of Chicago is Strong and Trusted

We are proud of our diversified client base and deposit and loan portfolios. We are also very proud of the way in which Republic Bank of Chicago has conducted business and supported its communities since 1964.

- No exposure to cryptocurrency or venture capital

- Well capitalized exceeding federal standards

- Diversified deposit mix with strong core relationships

- Diversified loan portfolio across industries and lines of business

- Strong, consistent earnings

Our strong capital structure and diversification in both deposits and loans fuels the growth and independence of Republic Bank of Chicago and positions us and our clients for ongoing financial success.

There’s never been a better time to bank with a strong and trusted financial institution like Republic Bank of Chicago.

*As of December 31, 2024.