Start Earning 4.30% APY Today

Start the new year off right with 4.30% APY1 in our Digital Money Market account.

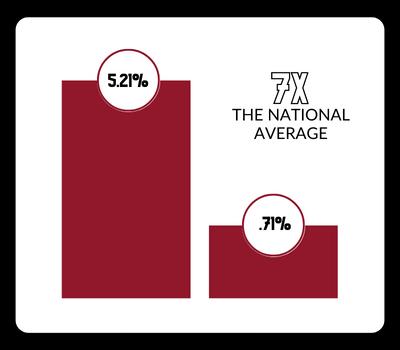

That’s 10x the national average2!

Available exclusively online, you can open your Digital Money Market in 5 minutes. Get started now.

Imagine the possibilities with our Digital Money Market at 4.30% APY1.

- Open account online in 5 minutes

- $2,500 minimum deposit to open account and avoid $25 monthly maintenance fee

- FDIC insured

Questions?

Get 4.30% APY in Our Digital Money Market Account

Earn 10x the national average2 while keeping your funds liquid for whatever you need, whenever you need it. Open your Digital Money Market account today, and experience the Republic Bank advantage for yourself.

Facts, Answers, and Questions

Great question. We’re a family-owned bank, and we’ve been dedicated to serving our clients since our first branch opened in 1964. Over the years, we’ve expanded our financial services, reinvested in our communities, and have grown to 19 locations throughout Chicagoland.

While our branches may only be in the Midwest, we embrace innovation, entrepreneurship, and hard work regardless of where you live. And the exceptional service we provide knows no geographic boundaries.

If you’re in a jam and need unbiased advice, we’ve got your back.

Our point? You can count on us to work hard for you.

Opening your account online should only take 5 minutes. You’ll need:

- Social Security Number

- Driver’s License or State ID

- Opening Deposit via ACH (you’ll need your funding account number and current financial institution’s routing number)

Need help? Call us at 800-526-9127. We’re available Monday through Friday, 7:00am – 6:00pm, and on Saturday from 8:00am – 1:00pm.

At the end of the application process, you can fund your account with any amount from $2,500 to $75,000.

Once your Digital Money Market account is open, you can deposit additional funds via check or wire transfer. You’ll need your new account number and our routing number, which is 071001180.

If your current financial institution’s Online Banking service offers “External Transfer,” you may add funds to your new Digital Money Market account using that functionality. Check with your current financial institution for their guidelines.

And, there is no limit as to how much you can ultimately deposit into your Digital Money Market account.

Call us at 800-526-9127 for more information. We’re available Monday through Friday, 7:00am – 6:00pm, and on Saturday from 8:00am – 1:00pm.

Yes, checks are available for your new Digital Money Market account. A pack of 16 checks costs roughly $30.00 (taxes, fees, and standard shipping included) and will be debited from your account.

Call us at 800-526-9127 for more information. We’re available Monday through Friday, 7:00am – 6:00pm, and on Saturday from 8:00am – 1:00pm.

No, we do not offer a debit card on this account. You can, however, order checks by calling 800-526-9127. You will need you account number and other identity identifying information.

At Republic Bank, we offer competitive rates that are largely determined by market conditions. If our Digital Money Market rate changes, that change applies to all Digital Money Market accounts.

At Republic Bank, it’s important to us to provide you with the resources you need to have a bright financial future.

Explore our posts and learn more about credit score myths, savings strategies, the benefits of smaller local banks, and more.

At Republic Bank, our bankers work hard to learn your story and become your advocate.

Get connected with us, and put Chicago’s hardworking bank to work for you today.

1Minimum balance to open account is $2,500. If balance falls below $2,500, a $25 maintenance fee will be assessed. Account must be funded with money not currently on deposit with Republic Bank of Chicago. Fees may reduce account earnings. APY is accurate as of 12/20/2024. APY may change and offer may be withdrawn at any time without notice.

210x based on FDIC monthly interest savings rate as of 12/20/2024.